While COGS can also include fixed costs, such as overhead, it is generally considered a variable cost. Variable costs are proportional to the volume of activities, increasing or decreasing as the business output changes. Fixed costs, on the other hand, remain constant irrespective of production levels.

Variable Costs Determine Margins and Net Income

Let’s assume that it costs a bakery $15 to make a cake—$5 for raw materials such as sugar, milk, and flour, and $10 for the direct labor involved in making one cake. The table below shows how the variable costs change as the number of cakes baked varies. In general, companies with a high proportion of variable costs relative to fixed costs are considered to be less volatile, as their profits are more dependent on the success of their sales. The break-even point determines the level of sales needed to cover all of the costs of production; fixed and variable costs. If a company is at the break-even point, they are neither making nor losing money.

What Comprises Marginal Profit?

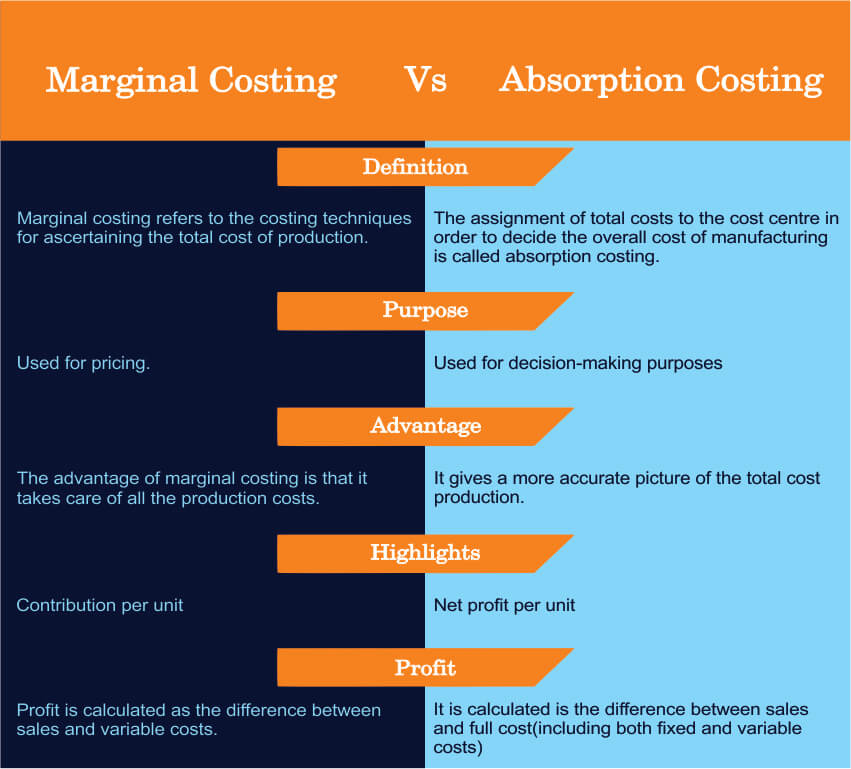

This differs from absorption costing which allocates all manufacturing costs, both variable and fixed, to the product cost. Variable costing is an accounting method that includes only variable production costs – direct materials, direct labor, and variable manufacturing overhead – in the cost of a product. Variable costing, or marginal costing, includes only variable calculate inventory management costs production costs like materials and labor in product costs. It treats fixed overhead costs as period expenses and doesn’t assign them to products. It can make a big impact on the per-unit price if a company has high direct, fixed overhead costs. Companies that use variable costing may be able to allocate high monthly direct, fixed costs to operating expenses.

Ask Any Financial Question

By continually monitoring and adjusting pricing strategies, businesses can ensure they maintain sufficient profit margins to cover expenses and provide returns on investment. Analyzing internal production costs vs. outsourcing supports informed sourcing choices to maximize profitability. The integrated accounting system will calculate both cost components automatically so as to provide convenience to the accountant. In addition, this automated accounting system will also provide financial statements in real time and accurately. Careful analysis of cost behavior is needed when comparing income figures between variable and absorption costing.

In 2024, the company produced 1,000,000 phone cases with total manufacturing costs of ₱33,700,000 (around ₱33.70 per phone case). Recently, they received a special order for 1,000,000 phone cases at a total cost of ₱22,500,000. Absorption costing is not as well understood as variable costing because of its financial statement limitations. But understanding how it can help management make decisions is very important. See the Strategic CFO forum on Absorption Cost Accounting that helps managers understand its uses to learn more. Since more costs are capitalized to inventory under absorption costing, inventory balances on the balance sheet tend to be higher compared to variable costing.

The manufacturer only considers variable manufacturing costs to ease cost control. Although the company has enough production capacity, the manager hesitates to accept the special order because it is lower than the ₱33,700,000 manufacturing cost stated in their financial report. As the company’s cost accountant, the manager asks for your input on whether to accept the order. Manufacturing companies often struggle with choosing the right costing method for their operations.

Full costing is an accounting method that explains all costs that companies incur in the production process, such as variable, fixed, direct, and investment costs. Businesses use two basic costing approaches variable costing and full costing. Variable costing, also known as marginal costing, is mainly used for internal reporting. Whereas, full costing, also known as absorption costing, is mainly for external reports. JDN, a phone case manufacturer, shared parts of its income statement for 2024.

Fixed costs are expenses that remain constant, regardless of changes in production or sales volume. Under variable costing, only those manufacturing costs that vary with output are treated as product costs. This would usually include direct materials, direct labor, and the variable portion of manufacturing overhead.

- In general, a company should spend roughly the same amount on raw materials for every unit produced assuming no major differences in manufacturing one unit versus another.

- In accounting, it is crucial to distinguish between direct and indirect variable costs to ensure accurate costing of products and services, and to make informed business decisions.

- In the previous example, imagine you manufactured 5,000 items but sold only 4,000, at $20 apiece.

- Because variable costs directly correlate with production and sales, they are essential for precise cost projections.

- Overall, variable costing is a valuable tool for pricing decisions, profitability analysis, evaluating risk, and cost management.

Ethical business managers understand the benefits of using the appropriate costing systems and methods. The accountant’s entire business organization needs to understand that the costing system is created to provide efficiency in assisting in making business decisions. Determining the appropriate costing system and the type of information to be provided to management goes beyond providing just accounting information.