This can be assumed because straight-line rent expense is the average of all required payments. When the cash paid is greater than the straight-line expense, the accumulated deferred rent will be reduced each period by the excess of cash paid over the expense incurred. By the end of the lease term, the deferred rent balance will be reduced to zero, as the total cash paid and expense incurred over the life of the lease is equal. Rent payable (or accrued rent) is simply the unpaid rent expense of a business entity at the end of its accounting period.

Journal entry for rent paid in advance

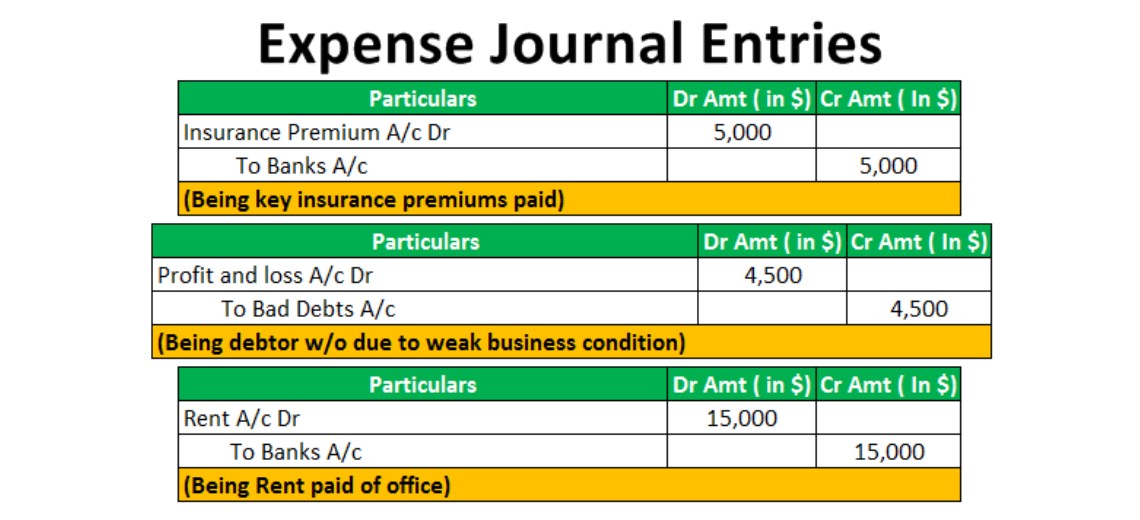

Step 2 – Transferring office rent expense into income statement (profit and loss account). It is important to document cash payments for rent, as this will provide evidence of the payment and will help to ensure that the rental agreement is fulfilled. Furthermore, this will help to provide an accurate picture of the financial situation of the company. ABC is a consulting company that provides many services to small businesses. Base on the rental contract, ABC needs to pay the rental fee on 5th of next month while the contract term is 5 years. Under ASC 842, none of these accounts are presented on the balance sheet.

Rent expense on the income statement

- When the check is written on the 25th, the period for which it is paying has not occurred.

- Furthermore, this will help to provide an accurate picture of the financial situation of the company.

- For example, if payments are made quarterly at the end of the quarter, expense will need to be recorded each month, before payment.

- However, you are recording the straight-line rent expense calculated by dividing the total amount of required rent payments by the number of periods in the lease term.

- Specifically, they record a lease liability equal to the present value of future lease payments and a right-of-use asset that corresponds to this liability, with adjustments for certain amounts.

The lease commences on January 1, 2022, and ends on December 31, 2031. As we mentioned, there is no change to the debt and increasing the rent expense account. But this time, the credit didn’t decrease an asset but rather increased a liability. The shift from credit to an asset to a liability still keeps the accounting equation in balance, and this is what we’ll quickly look at next. Following are the steps for recording the journal entry for rent paid by cheque.

Accrued rent vs deferred rent

On December 31, 2020, Hannifin must report in its balance sheet the rent payable of $2,500 as current liability. The transaction will remove the rent payable from the balance sheet. Rent is the cost that company spends to use someone’s property, office, building, and other types of fixed assets. The most common form of rent is the rent of property which company rents a building or office from the landlord.

Step 2: Calculate the rent expense by dividing the total payments by the lease term

This represents the benefit received in the period from the occupation or use of the leased asset. Then, on January 31, 2021, the company ABC can make the adjusting entry to record the rent expense by transferring the one-month balance of prepaid rent to rent expense with the below journal entry. Likewise, after this journal entry, the balance of the rent paid in advance that the company has recorded in the prior period will be will reduced by the rental fee for the period. Prepaid rent is an asset account, in which its normal balance is on the debit side. Likewise, in this journal entry, the net impact on the balance sheet is zero as one asset (prepaid rent) increases while another asset (cash) decreases.

For example, dealing with equity accounting or convertible notes is very difficult without a good grasp of the fundamentals. Income and expense a/c is debited to disaster relief resource center for tax professionals record the journal entry of rent paid. If the lease payment is variable the lessee cannot estimate a probable payment amount until the payment is unavoidable.

A similar adjustment will be made for any deferred rent expense at the transition to ASC 842. If deferred rent has a credit balance, the balance will be cleared with a debit and the offsetting credit will be recorded to the appropriate ROU asset. Conversely, if deferred rent has a debit balance at transition, a credit to deferred rent and an offsetting debit to the ROU asset will be recorded. Here is the journal entry at transition – showing the debit to accrued rent to remove the balance from a separate account and credit to the ROU asset to adjust the beginning balance.

On 5th of next month, ABC needs to pay the landlord and the rent payable will be reversed as well. The journal entry is debiting rent payable $ 2,000 and credit cash $ 2,000. Rental expense is present on income statement and rent payable is the current liability that is presented on balance sheet. The journal entry is debiting rental expense of $ 2,000 and credit rent payable $ 2,000.

The company can make the journal entry for the rent paid in advance by debiting the prepaid rent account and crediting the cash account. In this article, we will not be looking at balance day adjustments for rental payments. Please check out the respective links if you want more information on rent paid in advance or accrued rent expense. Since the rent expense is an average, there will be months where cash is more than the straight-line expense and correspondingly months where cash is less than the expense.